76% of repairs carried out during the lockdown were domestic

6/25/20 | GCO

"Grupo Catalana Occidente has analysed the profile of emergency actions carried out relating to home, businesses and community insurance during this period"

Grupo Catalana Occidente carried out 45,685 repairs during the months of the lockdown (from 14 March to 14 May). Most of these repairs were carried out in the domestic sphere (76%), followed by the actions undertaken as part of community insurance policies (22%) and, finally, those corresponding to business insurance (2%). In all cases, the actions carried out were emergencies or repairs necessary for security or to guarantee the proper functioning of basic facilities.

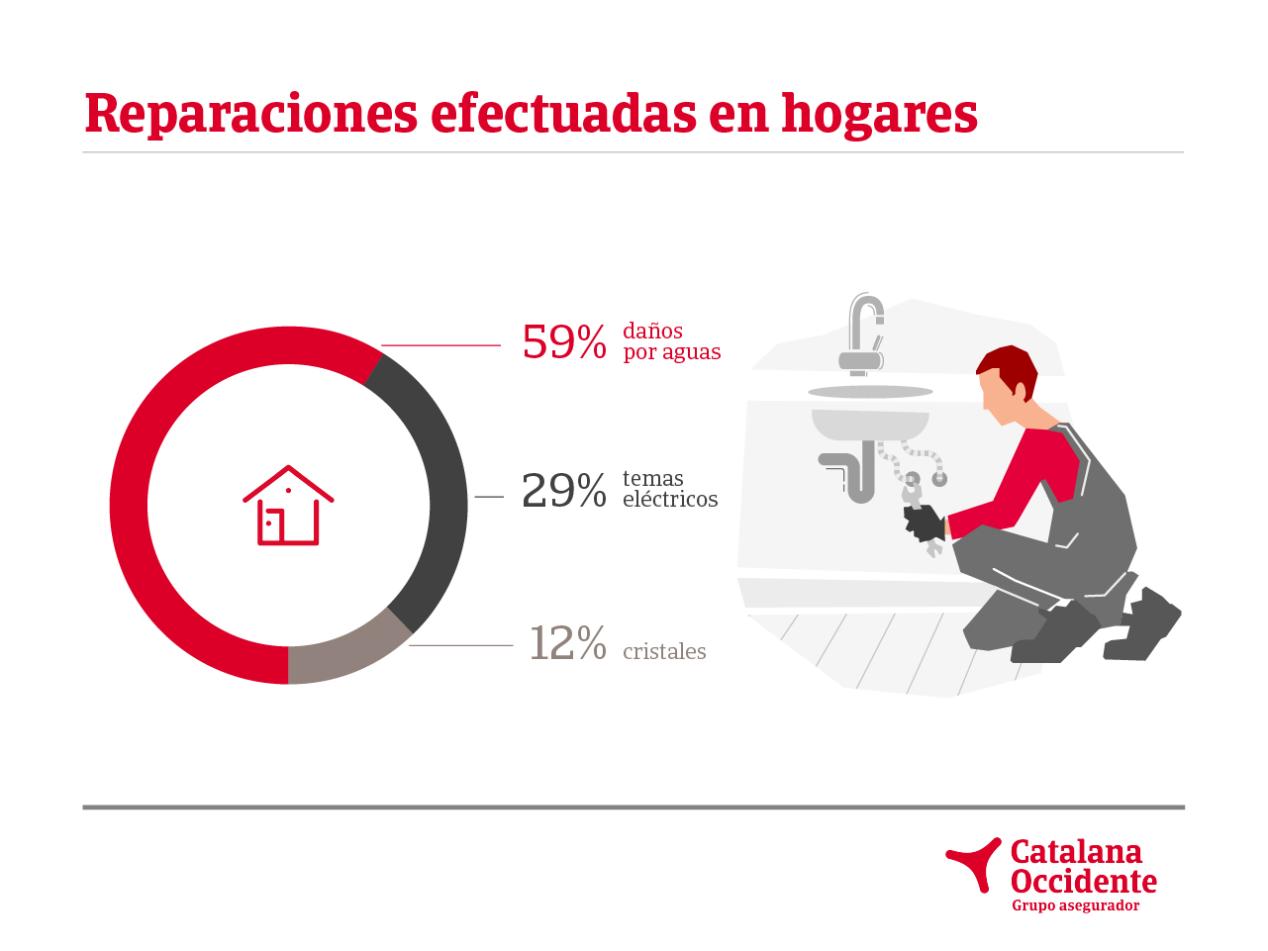

Looking in detail at each category, in home insurance, actions taken to repair water damage were in the top position (59%), followed by repairs due to electrical issues (29%) and, in third place, repairs for window damage and breakages (12%).

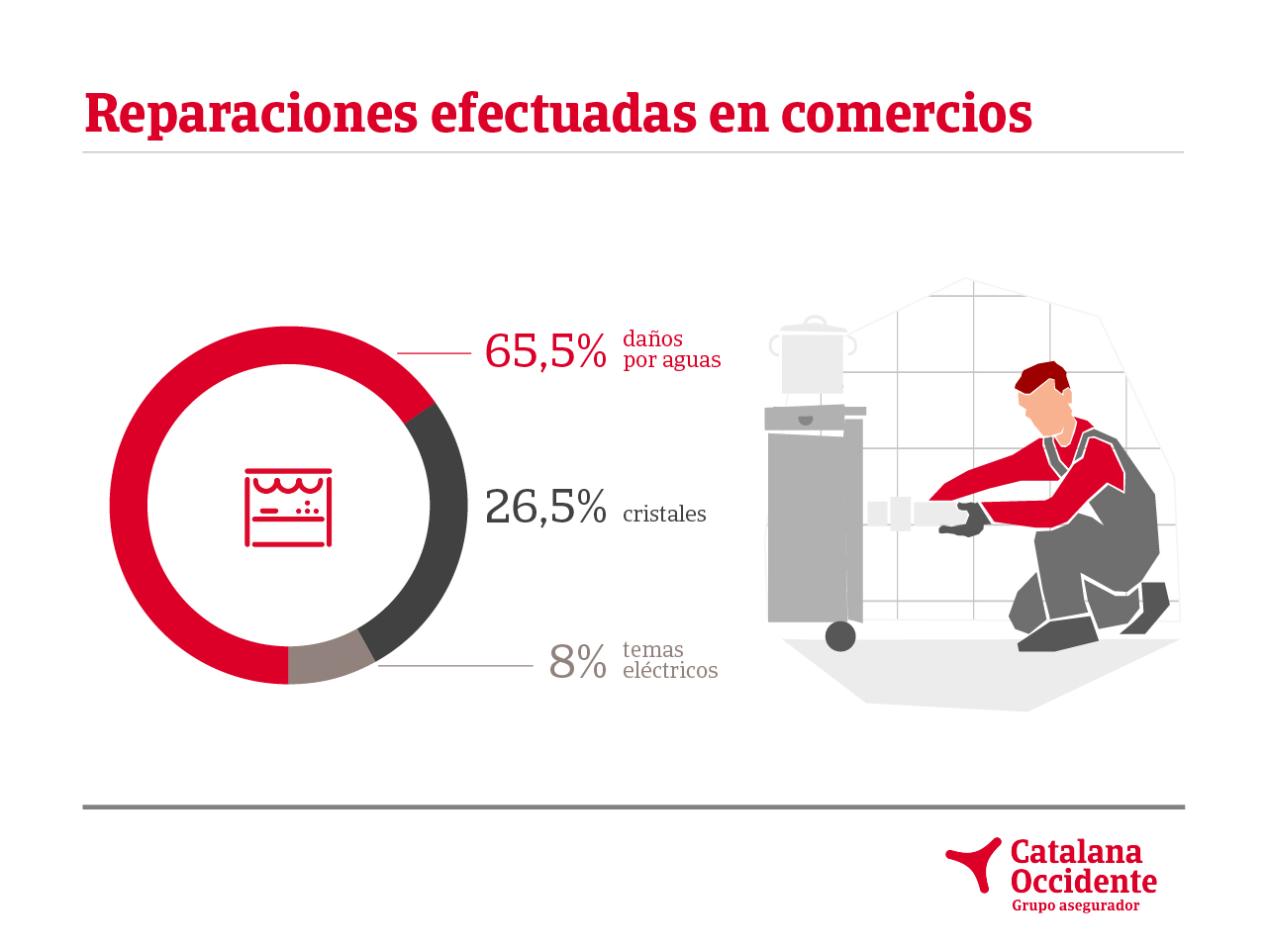

In terms of community insurance, repairs for water damage also represented the majority (84.5%), followed by unblockages (9%), glass (6%) and electrical damage (0.5%). With regard to business insurance, water damage was again the highest (65.5%).

Video damage assessment

The lockdown had a direct impact of the damage assessment and insurance activity, giving rise to the increase in video damage assessments. In the case of Grupo Catalana Occidente, the rapid adoption of this technology was made possible thanks to Prepersa, a company within the Group with 40 years' experience in expert damage assessment and risk inspections, which was already looking at video damage assessments as a possible service. The Group was quickly able to adapt its expert assessment processes to continue to attend to its customers, implementing this system as the most suitable means to carry out this work when a face-to-face visit was not possible.

During the two months of the lockdown, 37% of expert reports were carried out through video damage assessment, and 63% in person.The implementation of this new system was very fast, considering that before the crisis, 100% of the assessments were carried out in person.

The dynamic for carrying out a remote assessment is very simple and allows the best service to be provided in three steps. First, the expert contacts the insured person and sends him/her an SMS with a link from which the customer gives their permission for access to their smartphone's camera and audio. Then the video call begins and the expert guides the insured person so that they show the details of the incident.

With this system, the customer does not have to install any app or tool on their device; they simply access the link they receive from the insurer. The expert can also take the necessary photographs of the incident. Thanks to this tool, management is agile, secure and efficient for both the customer and the expert, as well as the company.

Contact for press and media

Jone Paredes

comunicacion@gco.com